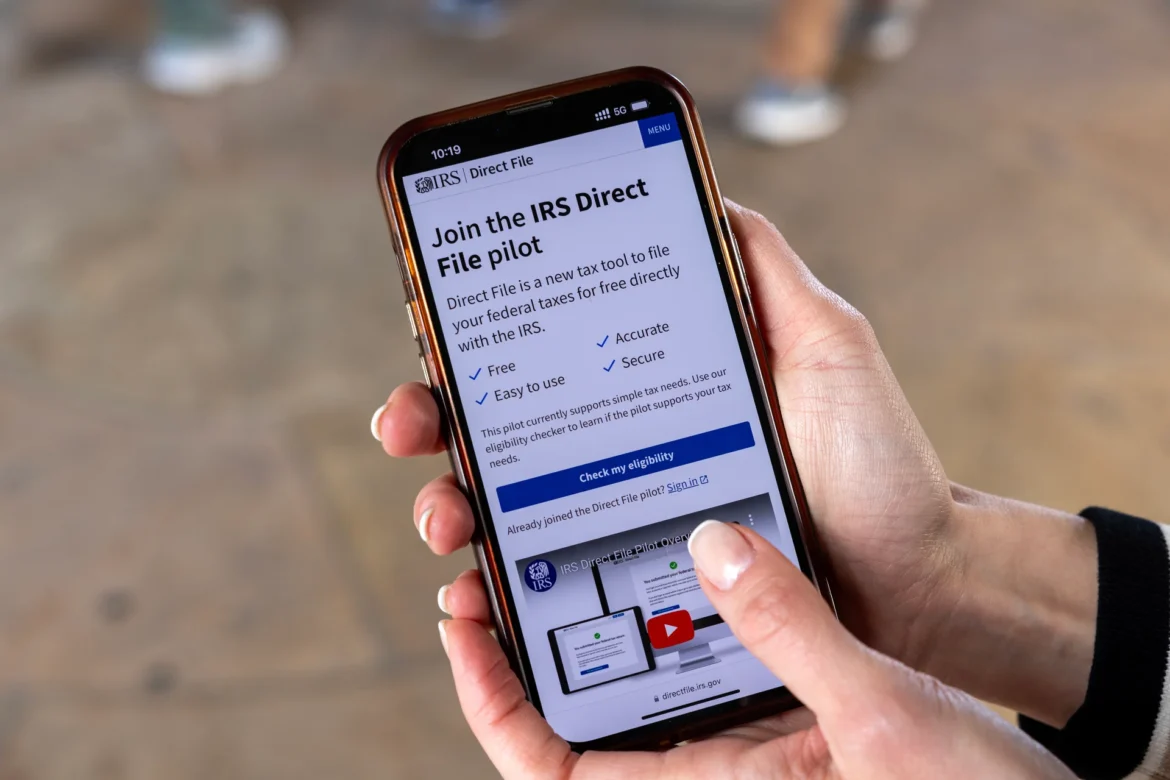

In a digital era where tax services have become part of a nation’s critical infrastructure, the U.S. Internal Revenue Service’s (IRS) decision to discontinue its free filing platform, Direct File, is more than a technical adjustment – it’s a strategic pivot. The tool, designed to simplify tax submissions and reduce citizens’ dependence on commercial platforms, will no longer operate in 2026. This move raises questions about the future of public digital initiatives that compete directly with private financial monopolies.

As we at YourNewsClub observe, Direct File stood out as one of the few examples of a government-backed digital service offering direct, no-cost access to essential financial tools. During the 2025 tax season, nearly 300,000 taxpayers used the system – double the number from the previous year. “The rapid adoption shows how strong the demand is for simple, transparent, and affordable solutions. Yet administrative politics and private pressure reshaped the narrative,” explains Jessica Larn, a YourNewsClub analyst specializing in technology policy.

According to IRS data, user satisfaction with Direct File exceeded 90%, with an average savings of $160 per filer compared to paid services. Despite these outcomes, the initiative faced consistent resistance from private tax-prep companies who viewed it as a threat to their market dominance. Lobbying groups and several Republican lawmakers argued that Direct File duplicated existing commercial offerings – even as those options remained complex and costly for lower-income taxpayers.

At YourNewsClub, we see this conflict as more than a market dispute – it’s a contest over who controls the flow of financial data. “In the modern economy, financial infrastructure is political infrastructure. Whoever controls the tax interface controls citizen behavior,” adds Maya Renn, who studies the ethics of computational systems and their role in shaping access to power.

The cancellation of Direct File aligns with a broader trend of reducing the government’s role in digital infrastructure. The new budget bill passed in mid-2025 only allocates funds to study the feasibility of new filing systems – without committing to actually build one. This effectively freezes the project indefinitely, while private providers such as TurboTax and H&R Block expand their advertising and raise prices in anticipation of a captive user base.

From an economic perspective, the implications are significant. Millions of Americans will lose access to truly free tax filing, and the average cost of tax preparation is expected to exceed $290. At YourNewsClub, we note that for the public sector, this marks a shift from digital inclusion to digital dependency – where basic access to tax services is once again mediated by private gatekeepers.

In our view, this decision represents more than financial inconvenience – it’s a symbolic retreat. It abandons the idea that a digital government can serve citizens directly rather than outsource that relationship. Unless the IRS revives Direct File or introduces a public alternative by 2026, Americans will find themselves paying subscription-style fees simply to fulfill a civic obligation.

Restoring balance, we believe, requires a new architecture of trust – one where digital governance remains accountable to citizens, not just to commercial ecosystems. At Your News Club, we argue that Direct File was more than just a tool; it was a test of whether accessibility could still stand as a true public value in the algorithmic age.