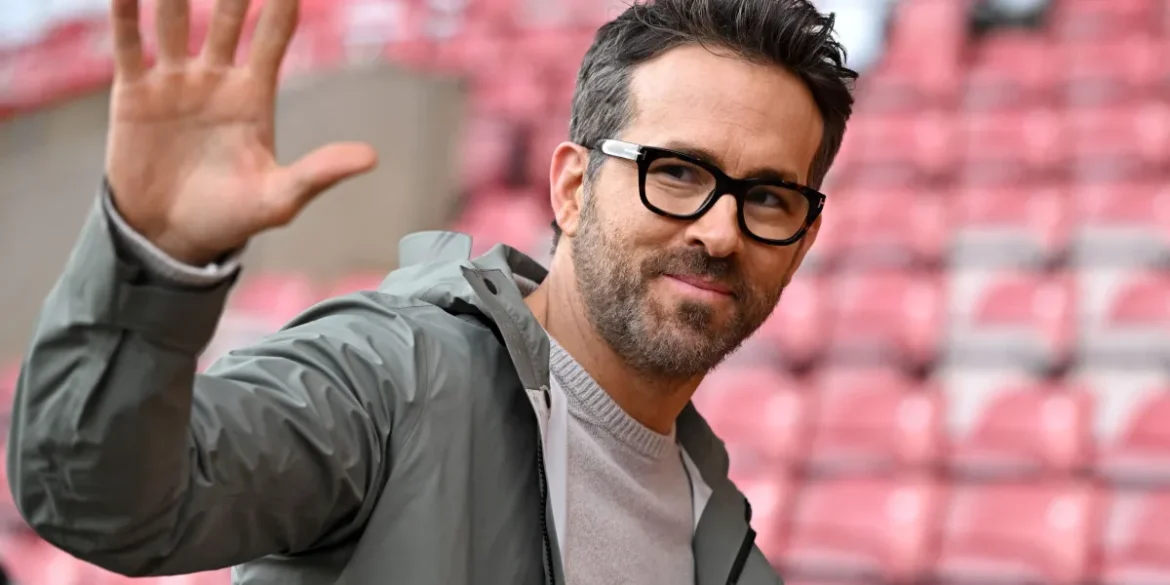

In a world where cyber threats evolve faster than economies, Toronto-based startup 1Password is transforming from a simple password manager into a foundational pillar of global digital security. Backed by Hollywood investors – Ryan Reynolds, Matthew McConaughey, and Scarlett Johansson – the company has surpassed $400 million in annual recurring revenue (ARR) and is now setting its sights on the next milestone: $1 billion in the coming years, according to our analysis at YourNewsClub.

CEO David Faugno calls this “a pivotal moment” for the company, noting that the rise of artificial intelligence is redefining the landscape of cyber threats and creating “a new trust economy,” where security is no longer a feature but an infrastructure.

At YourNewsClub, we see this as more than a financial milestone – it’s a signal of a deeper industry shift. “Companies can no longer just protect data; they must protect the architecture of trust itself,” says analyst Jessica Larn, emphasizing that cybersecurity is becoming both a political instrument and an economic shield.

Over the past two years, 1Password has shown the growth trajectory of a mature enterprise. Founded in 2005, the company now serves over 180,000 corporate clients, including Salesforce, Perplexity AI, IBM, and Oracle Red Bull Racing. Its systems safeguard 1.3 billion digital identities, positioning 1Password among the world’s largest authentication infrastructure providers.

Organizational changes have also reinforced the company’s evolution. Michael Hughes, former executive at ChargePoint and Barracuda Networks, was appointed president, while John Torrey, who previously held senior roles at Qualtrics and SAP, joined as chief business officer. According to Faugno, these additions strengthen 1Password’s push into large-scale enterprise contracts.

Financially, the company is on solid ground, having raised $950 million to date and reaching a valuation of $6.8 billion, according to Pitchbook. Its investor list includes not just celebrities but institutional names like CrowdStrike, Iconiq Capital, and CrowdStrike’s CEO George Kurtz – and as we at YourNewsClub observe, this blend of cultural and institutional capital gives 1Password a uniquely resilient market position.

Analyst Alex Reinhardt, who focuses on the intersection of finance and infrastructure systems, believes the company’s pivot toward enterprise clients represents “a new monetization logic for the data economy.” In his view, 1Password is moving toward a model where security itself becomes a liquidity layer in digital finance, not merely a protective service.

While an IPO is tentatively on the horizon for 2026–2027, Faugno insists the company is not in a rush to go public, emphasizing long-term independence and profitability over short-term market exposure.

At Your News Club, we believe 1Password’s trajectory exemplifies the evolution of a new kind of enterprise – one that doesn’t just sell technology but designs trust. If its projections hold, 1Password could soon redefine what it means to manage identity in the digital economy – shifting from safeguarding credentials to building the very framework of secure interaction.

In an age where passwords are fading into obsolescence, companies like 1Password are shaping the next frontier – a world where trust, not data, becomes the ultimate currency of cybersecurity.