Copper prices are ending the year at historic highs, reinforcing a narrative that has quietly been building across global commodity markets. Futures in Shanghai surged to record territory near 100,000 yuan per ton, while prices in New York strengthened sharply, extending one of the strongest annual performances among major industrial metals. At YourNewsClub, we see this move not as a short-term spike, but as an early signal of tightening fundamentals that could dominate 2026.

The rally has been driven by a convergence of forces. Investors are increasingly positioning for a decline in global copper inventories next year, while a weakening U.S. dollar has amplified upside momentum by making commodities cheaper for international buyers. The effect has been magnified by persistent flows of physical copper into the United States, raising concerns that supply availability elsewhere could become constrained.

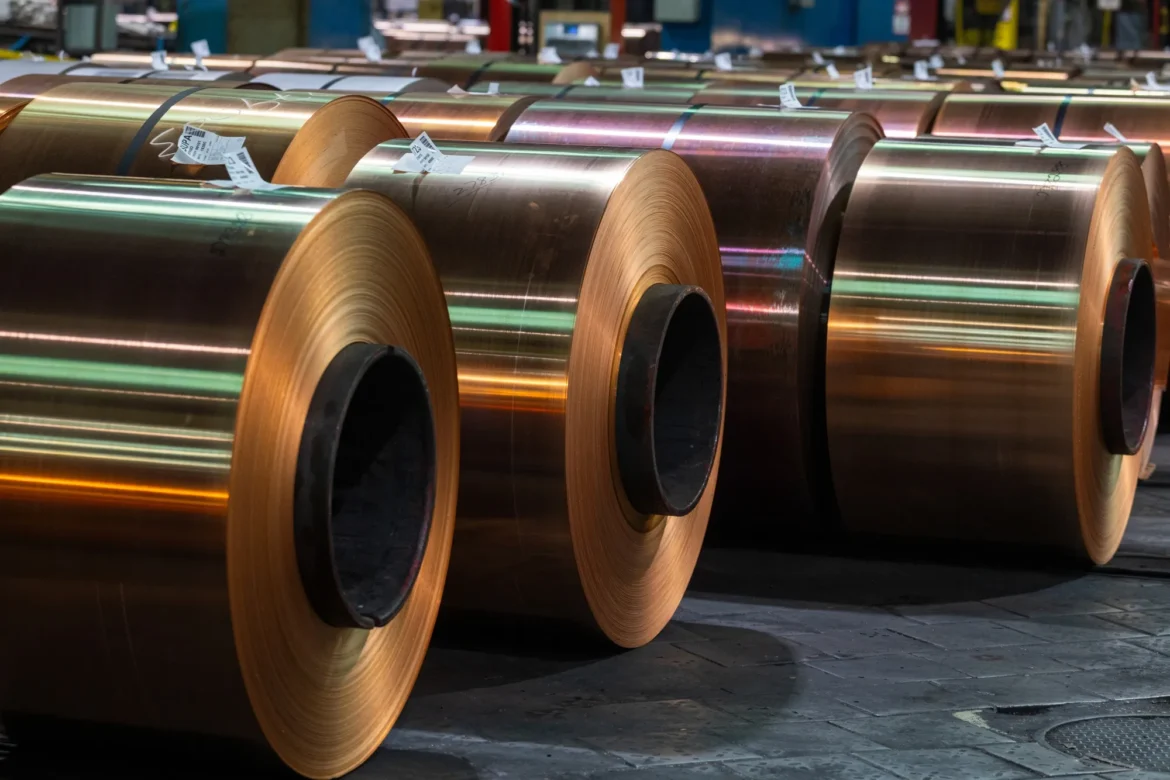

This year’s price action also reflects copper’s evolving role within the global energy transition. Demand linked to electrification, grid expansion, electric vehicles, and data infrastructure continues to grow faster than new mining supply. Project delays, permitting bottlenecks, and capital discipline among miners have limited the industry’s ability to respond quickly, leaving inventories vulnerable to even modest demand shocks. At YourNewsClub, we note that copper is increasingly behaving less like a cyclical industrial input and more like a strategic asset.

From a macro perspective, Ethan Cole, macroeconomics and central banks, argues that copper’s surge should be viewed as a forward-looking stress signal rather than a simple demand story. In his assessment, shrinking inventories combined with higher real-asset hedging demand are pushing investors to treat copper as a proxy for future infrastructure spending. He notes that when capital expenditure cycles accelerate faster than financing conditions adjust, price dislocations tend to follow.

Geopolitics adds another layer of complexity. Daniel Wu, geopolitics and energy, points out that copper supply chains are becoming more fragile as competition for critical minerals intensifies. He highlights rising resource nationalism, export controls, and strategic stockpiling as factors that reduce market flexibility. According to Wu, current prices suggest markets are beginning to price copper not just on consumption forecasts, but on security-of-supply considerations.

The weakening dollar has provided additional fuel. Recent declines in the U.S. currency index have delivered the largest weekly losses in months, reinforcing speculative and hedging flows into metals. While dollar moves alone rarely sustain commodity rallies, they can accelerate trends already driven by structural imbalance – a pattern clearly visible in copper markets this quarter.

Looking ahead, the risk is asymmetric. Upside scenarios hinge on continued inventory drawdowns and delayed mine expansions, while downside pressure would likely require a sharp global slowdown or a sudden surge in supply – neither of which appears imminent. At Your News Club, our assessment is that copper’s volatility will remain elevated, but price floors are moving higher.

For investors and policymakers alike, the takeaway is straightforward. Copper is no longer just an industrial metal reacting to business cycles. It is becoming a barometer of energy transition stress, infrastructure ambition, and geopolitical friction. At YourNewsClub, we believe 2026 will test whether the market can secure enough physical supply to meet these ambitions – and if it cannot, today’s record prices may look less like a peak and more like a baseline.