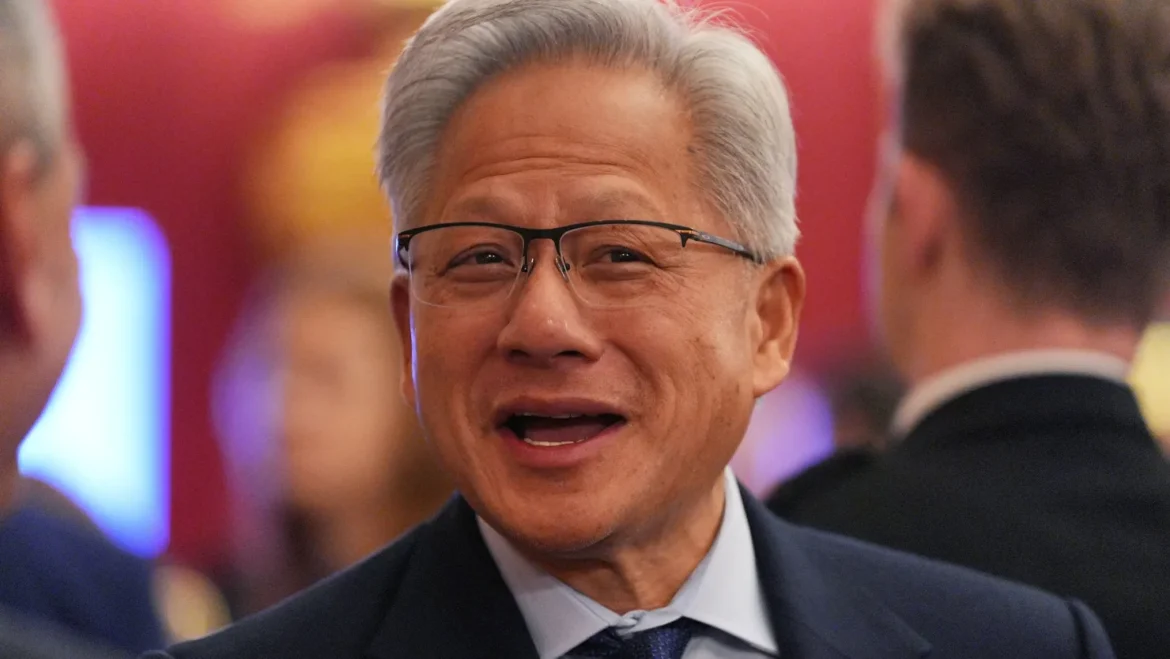

As the tech sector enters one of its most feverish cycles in years, Nvidia once again finds itself defining the pace. But this time the company’s ambitions extend far beyond the typical rhythms of the semiconductor industry. When Jensen Huang revealed in October that Nvidia had accumulated nearly 500 billion dollars in AI-related chip orders for 2025 and 2026, the market paused. At YourNewsClub, we see this not merely as a financial milestone, but as a declaration: Nvidia is trying to cement a new level of structural influence in an era where compute has become a strategic asset on par with energy or bandwidth.

The upcoming Blackwell and Rubin chip generations, combined with Nvidia’s suite of networking components, make up the bulk of this order book. With quarterly revenue up nearly 600 percent since 2020, the company’s growth curve has reshaped expectations across Wall Street. Some analysts now interpret Huang’s statement as a marker of the next expansion cycle; others warn that such numbers may fuel a dangerous overconfidence. Jessica Larn, who examines macro-level technology policy, notes that Nvidia’s messaging today helps shape the infrastructural climate of tomorrow, influencing corporate and governmental decisions long before the chips themselves ship.

Yet the market remains cautious: Nvidia shares still trade roughly 5 percent below where they stood in late October. Investors are wrestling with a central question – is the AI wave truly sustainable, or are hyperscalers overspending on compute infrastructure with no guarantee of near-term returns? Amazon, Google, Meta and Microsoft all sharply raised capital expenditure this cycle, signaling massive GPU demand. But these same companies have simultaneously accelerated work on their own ASIC architectures. At YourNewsClub, we see this as a shift from GPU monoculture to a fragmented landscape where Nvidia’s dominance remains powerful, but no longer uncontested.

Maya Renn, a specialist in computational ethics and access regimes, argues that the push toward in-house silicon isn’t just about cost or performance – it’s about who controls the entry points to artificial intelligence. As more companies develop proprietary chips, the structural leverage Nvidia once enjoyed begins to diffuse. This dynamic increasingly intersects with geopolitical fault lines, particularly in Asia.

Nowhere is this clearer than in China. Nvidia’s China-focused H20 chip was effectively blocked by export rules, and while Huang negotiated a licensing path with President Trump in exchange for a 15 percent share of China sales, the absence of a strong follow-up chip remains a revenue risk. For Nvidia, this could mean tens of billions left unrealized annually – a blind spot investors cannot ignore.

Meanwhile, Nvidia continues to play aggressively on the strategic investment front. Up to 10 billion dollars in OpenAI equity tied to the purchase of 4 to 5 million GPUs, 5 billion for a partnership with Intel, and another billion for a stake in Nokia all point to the same objective: creating an ecosystem that bends around Nvidia’s hardware. At YourNewsClub, we view this as an attempt to become not just a supplier, but an infrastructural layer of the AI economy – a high-risk, high-dominance strategy.

Analysts expect Nvidia’s upcoming quarter to show nearly 55 billion dollars in revenue, with further acceleration into January. But the real tension lies in the 2026 outlook. Huang’s half-trillion-dollar order book is both a promise and a pressure point.

Our conclusion at Your News Club is clear: the AI boom is shifting into a maturation phase. Growth remains strong, but peripheral strain is becoming evident. Nvidia’s strategies are evolving, competitors are sharper, and the industry is entering a period where the strongest players will be those able to build sustainable ecosystems around compute – not just procure it.

The strategic takeaway is straightforward: investors should watch the balance between backlog and realized shipments; enterprises should diversify their architectures; regulators should evaluate how AI infrastructure reshapes technological sovereignty. The race is far from over. And Nvidia – like the sector itself – is no longer competing for a quarter, but for the decade ahead.