Amazon is once again reshaping global commerce. While retailers worldwide brace for an economic slowdown, Jeff Bezos’s company is moving in the opposite direction – launching Amazon Bazaar, a separate low-cost shopping app aimed at emerging markets in Asia, Africa, and Latin America. What might look like a simple discount outlet is, in fact, a calculated bid to reclaim market share from Temu, Shein, and TikTok Shop – platforms that have captured a generation of cost-conscious shoppers.

At YourNewsClub, we view Bazaar not just as a commercial expansion but as a technological experiment. Amazon is building an entirely new ecosystem around affordability – testing how its logistics, personalization engines, and social-commerce mechanics can operate within local economic constraints. It’s less about price competition and more about rewriting the rules of scalable digital consumption.

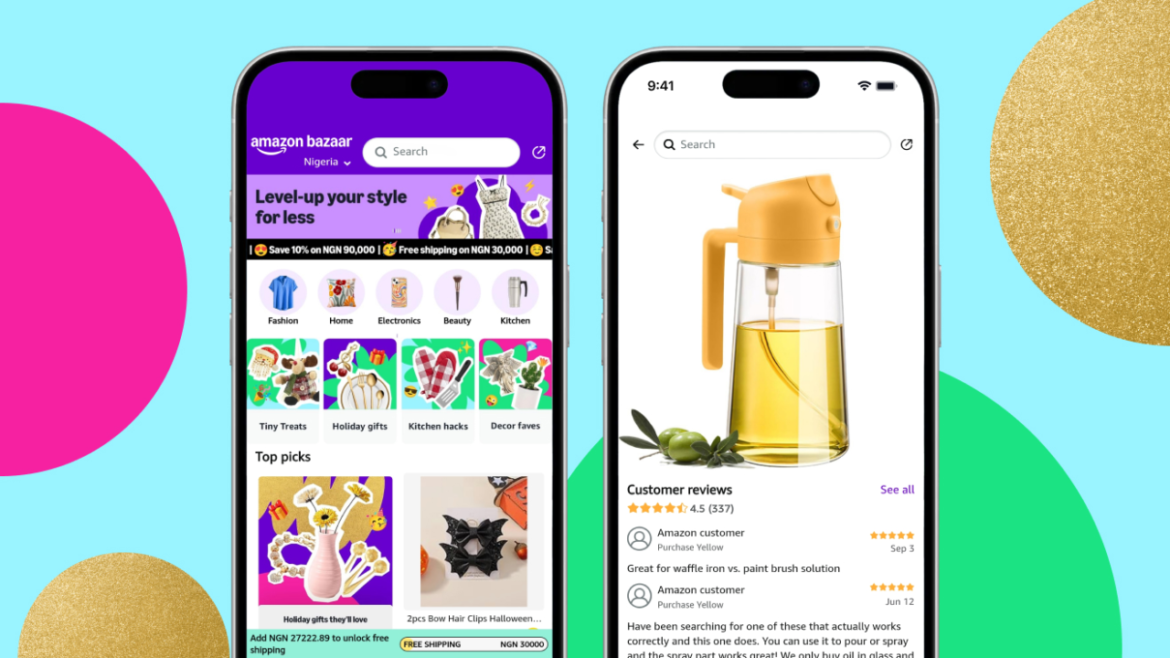

The app, already available in more than ten countries including Hong Kong, Kuwait, Peru, and Nigeria, offers most items for under $10, with some as low as $2. New markets are expected to follow soon. Unlike Amazon Haul, which remains embedded in the company’s core platform across the U.S., Europe, and Japan, Bazaar operates as a standalone product designed for mobile-first economies.

According to Maya Renn, a YourNewsClub analyst specializing in tech ethics and digital behavior, “Amazon Bazaar isn’t just a reaction to Temu – it’s a stress test for Amazon’s own adaptability. The company is exploring whether its global infrastructure can sustain efficiency and trust across vastly different consumer realities.”

The platform supports familiar Amazon features – customer reviews, ratings, and integrated payment options – while adding interactive shopping elements like gamified discounts and social raffles. New users receive a 50% discount on their first delivery, and customer support is available in six languages.

Owen Radner, who studies digital infrastructure at YourNewsClub, sees Bazaar as “a logistics laboratory wrapped in a retail experiment. Where Temu wins on speed, Amazon bets on credibility and systemic quality.”

Orders are shipped within two weeks and can be returned free of charge within 15 days. While Amazon avoids direct comparisons with Shein or Temu, its intent is unmistakable: to reclaim the budget-shopping segment that has drifted toward social-commerce platforms.

In our assessment, this launch signals a new stage of what we call “mass-efficiency capitalism” – a shift from premium branding toward frictionless access, where the shopping interface itself becomes part of the brand identity.

Investors remain cautiously optimistic. If Amazon can combine its unmatched logistics network with local market agility, Bazaar could evolve into one of the company’s most powerful international levers. Yet execution risk remains high: supply-chain pressures, regional regulation, and thin margins could all erode profitability.

Ultimately, the success of Amazon Bazaar will measure more than quarterly performance. It will reveal whether a trillion-dollar company can reinvent itself as both a marketplace and a cultural force in the age of digital minimalism. And if our analysis at Your News Club is right, this “low-cost experiment” may one day redefine the architecture of global retail itself.