After years defined by crises, regulatory pressure and eroded trust, Boeing has crossed a symbolic threshold. In an environment where confidence matters as much as capacity, YourNewsClub sees the company’s 2025 order performance as a signal that the market is once again willing to plan around Boeing – cautiously, but deliberately.

Boeing secured 1,173 net aircraft orders last year, overtaking Airbus for the first time since 2018. While Airbus still delivered more aircraft overall, Boeing’s order momentum reflects a shift in airline procurement strategy rather than a sudden competitive dominance. Airlines are locking in capacity far into the next decade, and diversification has become a risk-management tool rather than a preference.

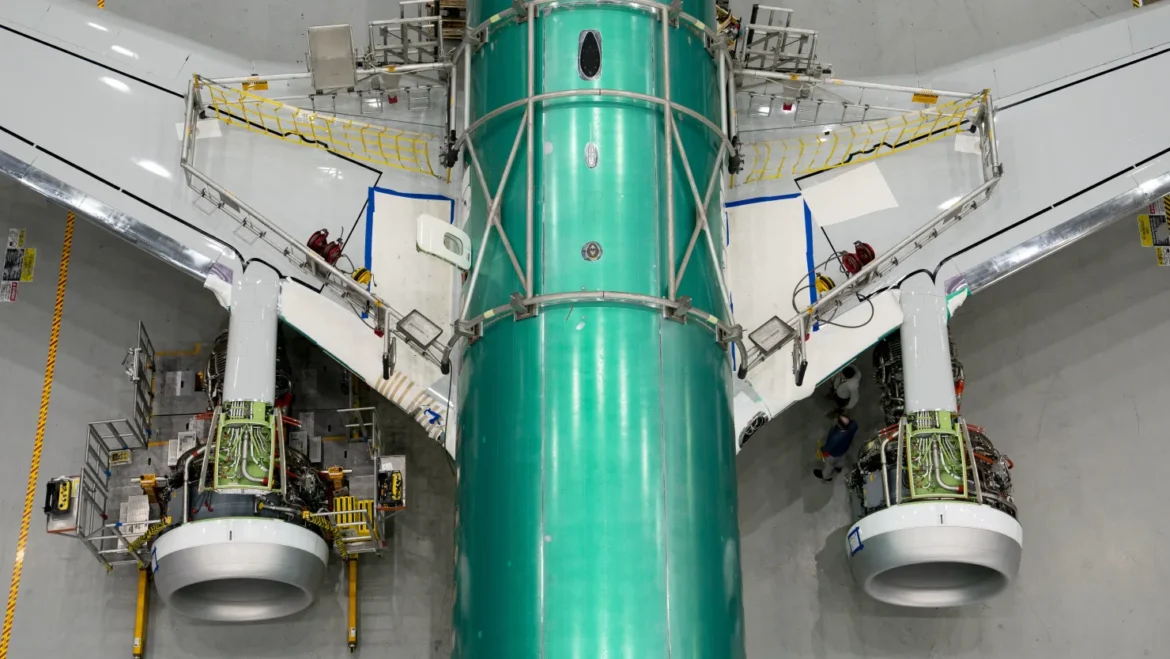

Deliveries tell a more measured story. Boeing handed over 600 aircraft in 2025, its highest annual total in seven years, with December accounting for 63 units, including a heavy concentration of 737 Max jets. Airbus delivered 793 aircraft during the same period, underscoring that supply-chain constraints continue to cap production across the industry. From YourNewsClub’s perspective, the gap between orders and deliveries is now the defining structural tension in commercial aviation.

Jessica Larn, technology policy and infrastructure analyst, notes that Boeing’s rebound is less about acceleration and more about normalization. Airlines, she argues, are responding to long lead times and geopolitical uncertainty by securing future slots wherever credible capacity exists. In this context, Boeing’s order book reflects restored baseline trust, not a return to pre-crisis dominance.

December’s surge in new commitments reinforces that view. Boeing recorded 174 new orders in a single month, including more than 100 737 Max aircraft from Alaska Airlines and at least 30 787 Dreamliners ordered by Delta Air Lines. Delta’s widebody purchase is particularly notable, marking its first such order from Boeing and pushing deliveries into the early 2030s – a reminder that airlines are planning fleet renewal on a generational timeline.

Owen Radner, digital infrastructure and industrial systems analyst at YourNewsClub, sees these long-dated orders as the real story. In his assessment, airlines are not betting on near-term execution gains, but on Boeing’s ability to remain operationally viable and strategically relevant over the next decade. That distinction matters: orders are being placed despite production bottlenecks, not because those bottlenecks have been resolved.

The risks remain substantial. Engine shortages, labor constraints and regulatory oversight continue to limit output, and any operational setback could quickly reverse sentiment. Boeing’s recovery, while real, remains fragile – a function of constrained alternatives rather than unlimited confidence.

As Your News Club interprets the current cycle, Boeing is no longer fighting for survival, but it is not yet competing from a position of strength. The company has re-entered long-term planning conversations with airlines, which is the most important step in any aerospace recovery. Whether it can translate that trust into consistent execution will determine whether this moment marks a true turning point or merely a temporary reprieve.

For now, the message from the market is clear: Boeing is back at the table – but the scrutiny has not eased, and the margin for error remains thin.