This holiday season in the United States is arriving with more than glittering displays and early-morning lines at the checkout. It comes with a quiet but powerful shift in price dynamics that consumers can feel even before they reach the register. Tariffs, once framed primarily as geopolitical leverage, are now reshaping everyday budgets. At YourNewsClub, we see this not as a temporary political maneuver but as an emerging structural layer of the consumer economy. The holidays still sparkle, yet the cost of celebration has taken on a new inflationary accent.

Recent modeling suggests that if the full tariff package had been active last winter, holiday spending would have carried an additional 40.6 billion dollars in costs. Of that, roughly 28.6 billion dollars would have fallen directly on consumers and 12 billion dollars on retailers attempting to protect volume and foot traffic. Translated into individual terms, that amounts to about 132 dollars per person – not a symbolic number for middle-income households already balancing higher borrowing costs, rent, and essential goods. From the perspective of YourNewsClub, seasonal spending is becoming a disciplined calculation rather than a festive reflex.

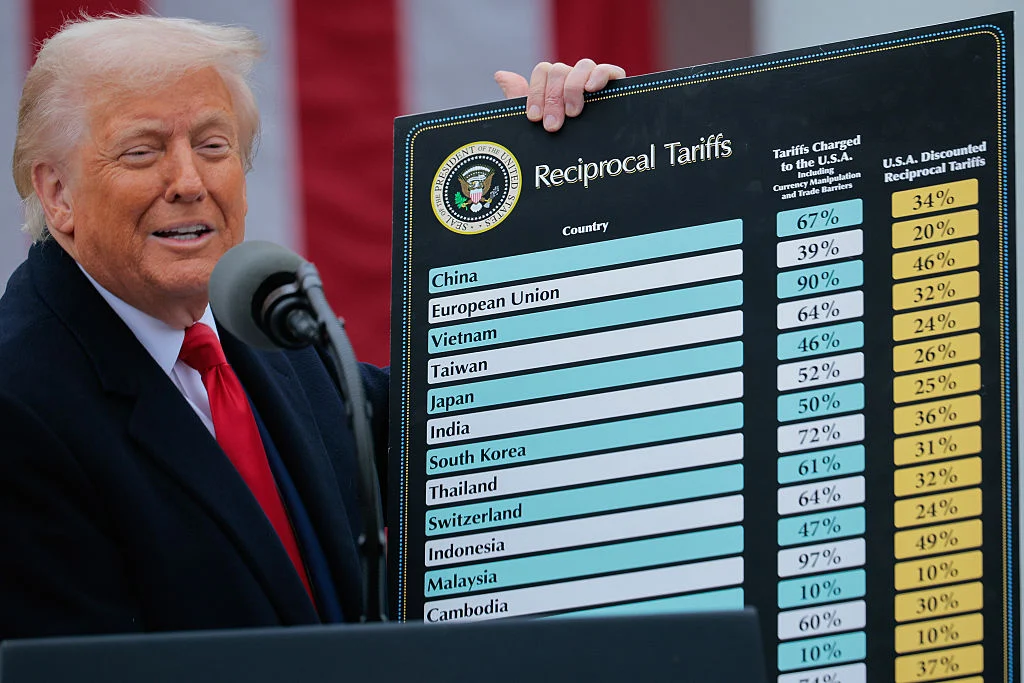

Import dependence intensifies the effect. About 88% of clothing and accessories and 69% of electronics purchased during the holidays are imported. What once looked like efficient globalization now acts as a direct transmission channel for tariff pressure into checkout totals. Electronics and apparel would shoulder the largest price lift, followed by home goods, jewelry, books and media, sporting and leisure items, and toys. These are precisely the categories families tend to stretch for in December, which means fewer opportunities to substitute or delay.

As Jessica Larn, a macro technology policy analyst, notes, tariffs today function as “a gate on everyday access to material and digital goods, not just a bargaining tool between capitals.” When political friction enters supply pipelines, she argues, consumers begin navigating a fundamentally different price reality. At YourNewsClub, we share that view: global logistics have evolved from a source of invisible comfort to a frontline of household inflation.

Higher seasonal costs inevitably feed consumer credit. Many shoppers now rely more heavily on credit cards and installment plans, converting holiday optimism into future obligations. For plenty of families, an unexpected 132-dollar burden means a genuine choice: shorten the gift list or stretch repayment timelines. Retailers feel the strain from both sides, caught between discounting to defend volume and protecting margin in categories already under pressure.

Alex Reinhardt, an analyst of financial systems and digital liquidity structures, draws a parallel: tariff surges resemble “micro monetary tightening cycles,” compressing consumer impulse and reshaping lender behavior. Higher import costs push shoppers toward credit, but higher rates and rising household balances amplify delinquency risks. At YourNewsClub, we see this dynamic playing out in tightening card limits and more selective lending in consumer finance.

Businesses are adapting, though with constraints. Some are reshaping assortments, scaling private-label offerings, or experimenting with localized production in niche segments. Yet supply-chain rewiring is slow, and the holiday calendar is rigid. Nominal spending may remain strong, but the composition is shifting toward value-seeking behavior, strategic purchasing windows, and greater use of financing tools.

Looking into early 2026, we anticipate a “soft January” effect: elevated revolving balances and seasonal fatigue may curb discretionary demand. For consumers, the smart play is to plan earlier, lock in promotions, compare prices carefully, and avoid “zero percent” traps masking hidden fees or interest accrual. Retailers should accelerate inventory turnover, diversify away from import-heavy SKUs where possible, and prioritize value bundles over aggressive markdowns. For investors, winners will be those with supply-chain agility, margin resilience, and fast pricing reflexes.

The holidays have always been emotional. But today the emotion sits beside a calculator. Tariffs have moved from policy talking points to lived financial experience. And as long as they remain embedded in national strategy, they will continue shaping not only the trade map but the gift list on the kitchen table – a reality we at Your News Club believe will define consumer behavior well into the next cycle.